We are a few weeks away from the beginning of the quarterly reporting season for the gold mining sector. The world’s largest gold producer, Newmont (NYSE:NEM), is expected to report Q3 results on October 24th. Other major producers like Agnico Eagle (NYSE:AEM) and Barrick Gold (NYSE:GOLD) will follow roughly a week later.

Today, I was considering what the Q3 results from the producers might look like, and I began reviewing some recent analyst research and the latest corporate presentations from Newmont and Barrick. Notably, Newmont has received several analyst upgrades over the past few months:

UBS even placed Newmont on its “most preferred” list earlier this week. All of this love from Wall Street means two things:

- The gold price has been rising and Wall Street doesn’t want to be left out.

- The analyst “channel checks” (conversations with management and industry insiders) are indicating to them that Newmont, and other gold producers, will deliver strong Q3 earnings reports.

While reviewing Newmont’s latest presentation a few things stood out to me:

Newmont expects costs to decrease across its entire portfolio over the next several years. While similar projections have been made by other major producers in the past, Newmont’s outlook is backed by a solid rationale. The company is still in the process of realizing synergies from its acquisition of Newcrest. By the end of 2025, Newmont is on track to achieve $500 million in annual synergies from this acquisition.

Additionally, several key operations, such as Lihir, Tanami, and Boddington, are set to benefit from capital investments and operational improvements made in recent years. For example, Boddington is now a fully autonomous mining operation, and Newmont is currently extracting higher-grade ore from both the North and South Pits. Since its construction in 2010, Boddington has consistently produced more than 800,000 gold equivalent ounces per year.

Newmont also sees its production profile steadily growing over the next several years:

Newmont is on track to produce 7.5 million gold-equivalent ounces in 2024, growing to 8.3 million gold-equivalent ounces by 2028. Newmont’s growth will be underpinned by production coming online at Ahafo North (Ghana), the Cadia block cave expansion (Australia), and expansion #2 at Tanami (Australia).

Newmont is also still using conservative metals price assumptions including $1,900 gold and $23 silver prices in its 2024 outlook sensitivity table:

Of course, this table is dated February 22, 2024 but it is useful to note that a $100/oz change in the gold price generates $675 million of additional revenue across the total Newmont asset portfolio. In Q2 2024, Newmont generated $594 million of free cash flow with a $2,347/oz average realized gold price. In Q3, the average realized gold price should be roughly $150/oz higher than Q2. The combination of the much higher gold price, lower energy prices, and increased production in the 2nd half of 2024 could result in Newmont delivering ~$1 billion in free cash flow in Q3.

UBS also likely sees the potential for Newmont to deliver stellar Q3 with a positive outlook when the company reports earnings on the morning of October 24th.

The prospect of a billion-dollar free cash flow quarter, along with a strong guidance outlook from Newmont through 2025, should be sufficient to prompt another wave of analyst upgrades on Wall Street.

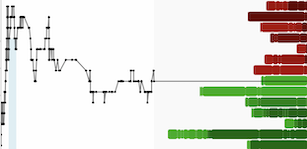

NEM (Daily)

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.